Are you behind in your tax returns?

This article explains to you the simple steps to take to catch up on outstanding tax returns or late tax returns. With the right assistance, you could be up to date with all your refunds within a month

1. Find out how many years of tax returns are overdue

Best to contact your accountant and ask them to check your lodgement status. If you don’t have a current accountant send our office a message https://www.smbaccounting.com.au/contact/and one of our accountants will be in contact to discuss as tax agents, we have more access to your tax records via the tax agent portal. This is a 2 minute job where we can look back to 2001 to see which returns are outstanding.

2. You may not need to lodge a return at all!

You need to lodge either a tax return or in many circumstances a non-lodgement advice as long as certain conditions are met eg your income was less than the tax free threshold and you had paid no tax.

Again your accountant can advise you on whether any conditions apply to your circumstances https://www.smbaccounting.com.au/contact/

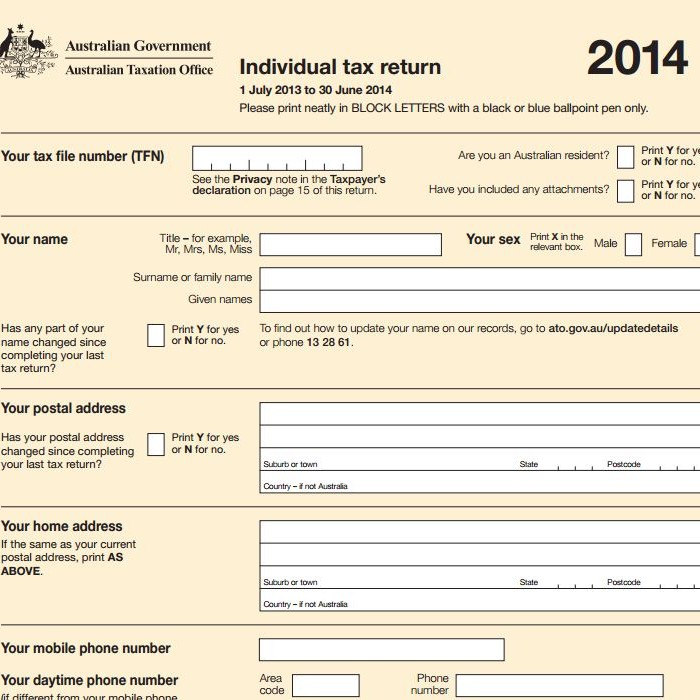

3. Get all your paperwork together

This is the most overwhelming step for most, and this is where we can assist as accountants by providing your ATO prefilling report. This is a report where the ATO collects information from various sources by matching up your Tax File Number.

Prefilling reports are available from 2007 onwards, however you will still need to collect your receipts if you wanted to claim any deductions. Just remember though, some deductions are available without substantiation which your accountant can assist you with https://www.smbaccounting.com.au/contact/

4. Complete your returns

An accountant can prepare the returns for you as our software backdates to the year 2000, if not further beforehand. Otherwise you would have to manually lodge prior years and this can take a lot longer to finalise.

Your refunds could be back in your bank within 2 weeks!

If you are a business, have outstanding returns and financial statements to prepare and you are avoiding due to the cost of getting them done, we will allow that cost to be paid over a 12 month period!

Contact SMB Accounting now! Phone 0437 726 731 or https://www.smbaccounting.com.au/contact/

Leave a Reply

Want to join the discussion?Feel free to contribute!